By Viswesh Ananthakrishnan, Sr. Director of Product Management, Auradine Inc.

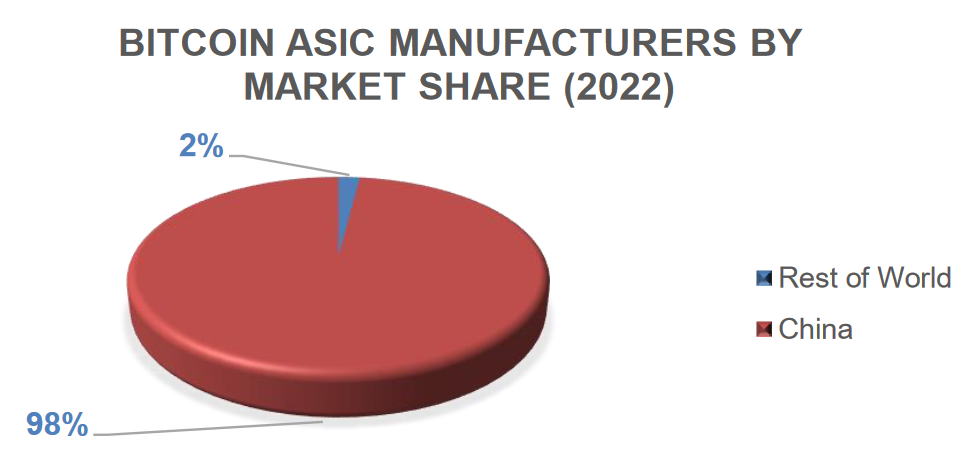

Advanced semiconductors are crucial components in Bitcoin mining solutions, providing the computational power necessary to solve complex mathematical problems and earn mining rewards in the form of Bitcoins. At present, China has a manufacturing monopoly on ASICs used in Bitcoin mining. However, the size of the Bitcoin mining industry (by market capitalization) outside China is disproportionately much larger.

Top 3 vendors viz. Bitmain, MicroBT, and Canaan own >95% share

https://www.giiresearch.com/report/qyr1258034-global-asic-bitcoin-mining-hardware-industry.html

Top 3 vendors are US based enterprises with combined ownership ~65%

https://companiesmarketcap.com/bitcoin-mining/largest-bitcoin-mining-companies-by-marketcap/

This lopsided distribution shows that even though China may have a stronghold on the manufacturing front, other countries and regions are contributing significantly to the overall growth, development, and profitability of Bitcoin mining. The decentralized nature of Bitcoin allows participants from around the world to engage in mining activities, resulting in a diverse and widespread ecosystem beyond the borders of any single country. It only makes sense that the design and manufacturing of Bitcoin mining ASICs should follow suit.

Unfortunately, the US semiconductor industry’s share in global semiconductor production capacity has seen a sharp decline over the last 30 years, falling from 37% to just 12%. This decline has been driven by increased competition from other countries and a lack of investment in domestic manufacturing capabilities. Recent events have demonstrated how vulnerable US businesses are to supply from overseas ASIC manufacturers. The COVID-19 pandemic had a significant impact on the semiconductor supply chain, causing disruptions and shortages that have affected a wide range of US industries.

Indeed, it has become crucial for the US to invest in and support its domestic semiconductor industry to ensure long-term growth and stability, in general for the broader economy and also specifically for the Bitcoin mining industry.

“Making more semiconductors in the United States […] will strengthen our national security by making us less dependent on foreign sources”

– Joe Biden, 46th President of the United States, July 2022

In response to these challenges, the Biden-Harris Administration has launched efforts to bring semiconductor manufacturing back to America through the CHIPS and Science Act. While these efforts represent important steps forward, there is still much work to be done to rebuild the U.S. semiconductor industry and ensure its long-term competitiveness.

Meanwhile, the economic significance of the Bitcoin mining industry in the US cannot be overstated, with a projected compound annual growth rate (CAGR) of 9.3% between 2023 and 2029, starting at $9 billion in 2022. The maturation of capital markets and the development of financial instruments have played a key role in the quick ascent of the Bitcoin mining industry in the U.S. In recent years, there has been a surge of interest in Bitcoin and other cryptocurrencies from institutional investors. Recently, several asset management firms, including BlackRock and Fidelity, have filed applications with the SEC to launch Bitcoin ETFs.

“The role of crypto is digitizing gold. […] Let’s be clear, bitcoin is an international asset, it’s not based on any one currency and so it can represent an asset that people can play as an alternative.”

– Larry Fink (CEO of Blackrock), in an interview with Fox News, July 2023

The development of Bitcoin ETFs could further accelerate the growth of the Bitcoin mining industry in the U.S. If approved, these ETFs would make it easier for investors to gain exposure to Bitcoin through existing financial infrastructure and eliminate the need to hold the cryptocurrency themselves. This could lead to a surge in demand for Bitcoin from US investors and further growth of the mining industry in the U.S.

Local governments can play a crucial role in supporting their local Bitcoin mining industry by providing regulatory clarity, investing in infrastructure, offering tax incentives, promoting education and research, collaborating with industry associations, and supporting entrepreneurial initiatives. This support can foster economic growth, technological innovation, and job creation within the cryptocurrency mining sector. Examples from around the world, such as Crypto Valley in Switzerland, Inner Mongolia in China, Texas in the US, Alberta in Canada, Iceland, and Kazakhstan, demonstrate the different approaches governments can take to support their local mining industry. By providing a supportive environment for Bitcoin mining, local governments can attract and retain mining operations, contributing to the local economy and promoting the growth of the broader cryptocurrency industry.

In conclusion, recent developments in the geopolitical landscape and the strained relationship between the US and China in the advanced semiconductor and related technologies sectors portend a serious threat to the growth of several US industries. Specifically, US-based Bitcoin miners face significant challenges with the unpredictable supply of cutting-edge ASICs, potential security issues, and continued profitability.

It is critical for the United States to invest in designing and manufacturing advanced semiconductors for Bitcoin mining. This will help ensure a resilient supply chain, promote economic vitality, and maintain technology leadership in this rapidly growing industry. Continued investment and support for the domestic semiconductor industry is essential to achieving these goals and ensuring the long-term competitiveness of the U.S. in the global market for advanced semiconductors and systems.